Transforming The Industrial Landscape

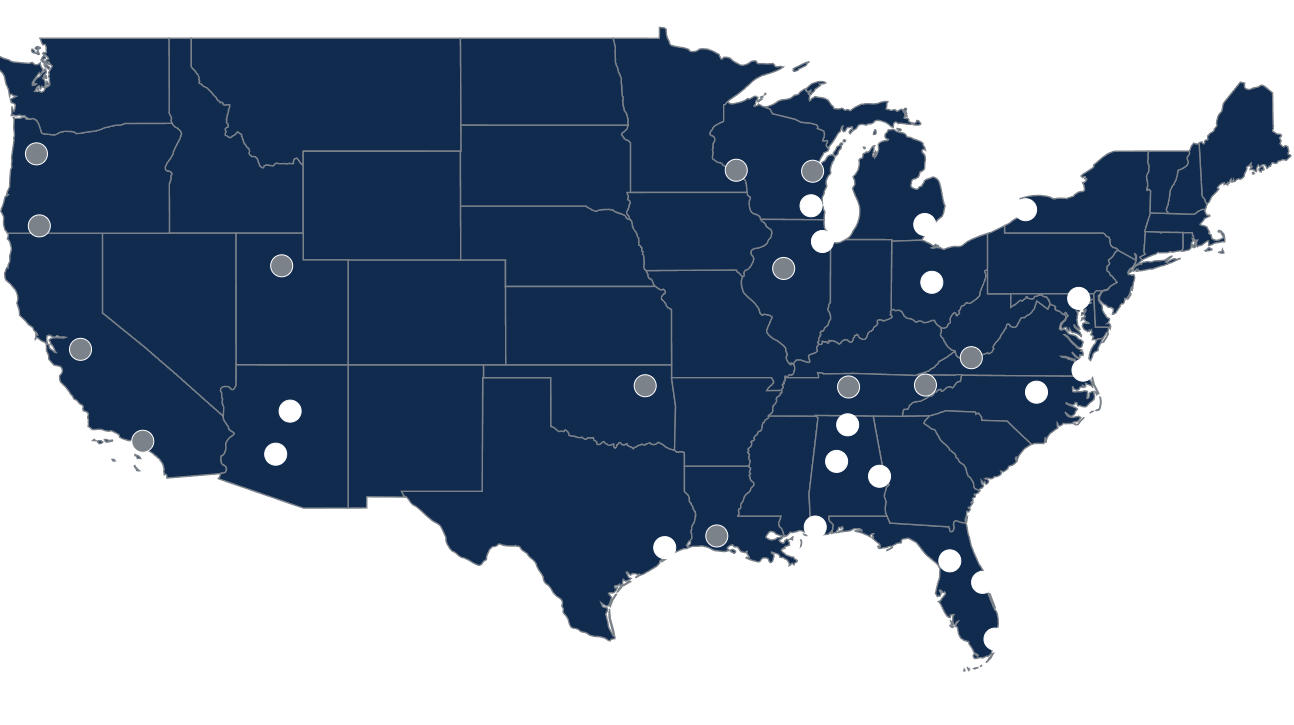

Reich Brothers is a national industrial real estate firm with a specialization in the acquisition, repurposing, and management of manufacturing and distribution facilities across the United States.

With over 15 million square feet of commercial real estate currently under management, Reich Brothers is the go-to for complex asset transactions nationwide.

Million SF

To Date

Buildings

To Date

About Reich Brothers

Reich Brothers is a leading acquirer of industrial real estate with a niche expertise in large scale manufacturing, distribution and freezer/cold storage assets. The Company has been at the forefront of revitalizing underutilized industrial facilities for the past thirty years and has owned and operated in excess of 50,000,000 square feet across the United States. Reich Brothers’ multiple disciplines work in tandem, including in house asset management, property management, construction, and equipment disposition.

Acquisition

› Corporate Closures and Consolidations

› Bankruptcies

› Owner-User Sales

› Sale Leasebacks

Reposition

› Equipment Liquidation and Removal

› Demolition

› Environmental Remediation

› Structural and Cosmetic Renovation and Rehab

Management

› In House Asset and Portfolio Management

› Local Facility Managers

› Site Security and Maintenance

Acquisition

› Corporate Closures and Consolidations

› Bankruptcies

› Owner-User Sales

› Sale Leasebacks

Reposition

› Equipment Liquidation and Removal

› Demolition

› Environmental Remediation

› Structural and Cosmetic Renovation and Rehab

Management

› In House Asset and Portfolio Management

› Local Facility Managers

› Site Security and Maintenance

About Reich Brothers

Reich Brothers is a leading acquirer of industrial real estate with a niche expertise in large scale manufacturing, distribution and freezer/cold storage assets. The Company has been at the forefront of revitalizing underutilized industrial facilities for the past thirty years and has owned and operated in excess of 50,000,000 square feet across the United States. Reich Brothers’ multiple disciplines work in tandem, including in house asset management, property management, construction, and equipment disposition.

Reich Brothers LLC

172 South Broadway

White Plains, NY 10605

(914) 614-1800